Risks can infiltrate quietly and create significant damage. The question is, are you using a vigilant guard or relying on a sleepy watchman?

While running a business, risks can take place at any time, impacting your growth and operations. Given these risks, businesses must adopt strategies that continuously safeguard them against threats. Risks can be classified into internal and external categories from the perspective of running an organization.

According to experts, external risks like a data breach can cost firms a loss of $4.4 million on average. It indicates how harmful ignorance can be while identifying and tackling risks. Automated risk management can offer a proactive approach in this regard, saving your business from devastating threats.

In this blog, we’ll learn how automating risk management can be advantageous for your business. Let’s dive in…

Defining Automated Risk Management:

Automated risk management is a process for identifying, analyzing, and eliminating risks automatically using sophisticated tools and technologies, such as AI, ML, data analytics, and real-time monitoring. This approach is generally adopted by businesses looking for robust risk management strategies.

By automating data collection, rule-based checks, and machine-learning models, it replaces slow manual methods with real-time monitoring, dynamic risk scores, and alerting. Teams gain prioritized insights, interactive reports, and governed workflows that drive faster, consistent decisions while preserving human oversight for approval.

Service providers enable custom rules, live data integrations, and instant risk scoring, while partner-management solutions embed risk checks to improve transparency. As a result, companies gain reduced exposure, easier regulatory reporting, and a proactive security posture that scales with business complexity, while freeing teams to focus on strategic risk reduction and innovation. It further accelerates decisions, improves audit trails, and supports resilient growth.

How Risk Management Automation Works?

Automated risk management follows five broad steps while making risk identification, assessment, and mitigation easier.

- Define Your Risk Parameters and Framework: Defining the risks that can be harmful to your business is the foundation of automated risk management. It provides clarity on the risk management framework for identifying, assessing, and mitigating risks.

- Automated Data Collection for Risks and Control: As per the risks defined, the risk management framework collects data automatically depending on various sources. Following data collection, it integrates the data into the existing system.

- Automated Risk Identification and Assessment: Based on the integrated data, the framework enables automated scanning for vulnerabilities, vulnerability assessment, and real-time risk detection. The risks are categorized accordingly as per their threat level.

- Automate Mitigation and Response: The risks are then automatically mitigated, initiating appropriate security controls and measures. The workflows are accordingly optimized with automatic incident response.

- Initiate Continuous Monitoring and Reporting: Following mitigation, the risk management system initiates real-time monitoring using key risk indicators (KRIs) to generate alerts for anomaly detection automatically.

Why Your Business Needs to Automate Risk Management?

Risks can be intentional and unintentional, internal and external. Such risks can impact business processes significantly, affecting financial and operational components. As per sources, 10% of startups fail to survive even the first year after their establishment due to ineffective risk management strategies. Hence, it is quite essential to adopt risk management tactics. However, manual approaches can be slower and more efficient as they continuously require human intervention.

Furthermore, manual strategies fail to integrate robust data analysis, resulting in a failure to initiate continuous monitoring. On the other hand, an automated framework can offer a holistic approach to detect, analyze, and eliminate risks while assessing vast datasets, alongside offering continuous monitoring. Additionally, it addresses the key challenges of traditional methods, including internal error detection, ineffective coordination, and inefficient resources. Risk management also ensures compliance with the leading data privacy laws.

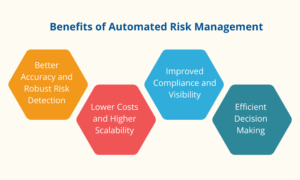

Here are the Key Benefits of Automated Risk Management:

Better Accuracy and Robust Risk Detection: Automation in risk management delivers high accuracy and robust error detection. Its automated data collection, assessment, and reporting enhance error detection efficiency and provide appropriate mitigatory tactics.

Lower Costs and Higher Scalability: Automated frameworks reduce costs significantly by eliminating the need to invest in manual workloads. Manual systems require continuous human intervention at every stage. Managing such a vast workforce can lead to higher investments, but for comparatively inefficient processes.

Improved Compliance and Visibility: Automated tools and strategies ensure adherence to the set data privacy laws, like GDPR and HIPAA. So, it helps you stay compliant with the changing regulations, offering better visibility around the threat ecosystem.

Efficient Decision Making: Data-driven intelligence, risk categorization, and mitigatory strategies enable organizations to make better decisions and protect their businesses from threats.

Use Cases of Automated Risk Management:

Automated risk management can strengthen the security framework of businesses in many ways. Let us discuss the industry-centric use cases-

Finance:

Financial service providers are prone to dangerous risks such as fraud, credit risks, regulatory compliance, and market shifts. An automated framework enables real-time transaction monitoring and anomaly detection, which contributes to efficient fraud detection.

Alongside that, AI-driven analysis, predictive modeling, and automated monitoring help in addressing challenges of credit risks, market shifts, and compliance parameters.

Cybersecurity:

Cybersecurity firms continuously face challenges of inefficient threat detection, prevention, vulnerability management, incident response, and others. Intelligent risk tracking, automated scanning, and incident response mitigate these concerns, offering a resilient risk management approach.

Manufacturing:

Common risks that the manufacturing industry faces are supply chain disruptions, operational failures, and product lifecycle management. Risk management automation offers advanced disruption monitoring to streamline supply chain functionalities.

Predictive maintenance, quality control, and resource optimization help address operational risks of manufacturing. Furthermore, risk management automation helps in analyzing product quality standards and IP violations to optimize product lifecycle-related risks.

Retail:

Demand management, customer behavior analysis, transaction fraud, and inventory management often become risky components for retail firms. ML-driven forecasts initiated by automated risk management enable retailers to understand market demand fulfillment. It also assists in analyzing customer behavior.

Apart from that, continuous data analysis and monitoring support retailers in managing their inventories efficiently.

Healthcare:

Healthcare providers frequently encounter risks related to clinical safety, operational disruptions, and revenue cycle management (RCM). Automated risk management enables predictive diagnostics and medical imaging, thereby maintaining patient clinical safety. To address operational disruptions, it enables smart scheduling, report generation, and advanced patient onboarding.

It additionally integrates sophisticated RCM models to streamline billing and cash flow.

Eliminating Risks for a Better Future!

Identifying and eliminating risks are crucial for businesses looking for sustainable progression. Ignoring risk can lead to major disruptions, operational failure, or even business shutdown. So, it is crucial to adopt vigorous risk management strategies. An automated process, in this regard, not only allows effective threat detection but also enables organizations to implement advanced strategies to mitigate them.

Automated risk management can be beneficial for businesses across industries, from finance to manufacturing. Alongside reduced cost, this approach offers high scalability, allowing organizations to make better financial decisions.

Dive into the world of technology and innovation with our in-depth blogs!

FAQs:

Q1. What are the 7 steps of RMF?

Answer: Prepare, categorize, select, implement, assess, authorize, and monitor are seven crucial steps of the risk management framework.

Q2. What are the four types of risk management?

Answer: Avoidance, reduction, transfer, and acceptance are the four broad types of risk management.

Q3. What are the 5 C’s of risk management?

Answer: Character, capacity, capital, collateral, and conditions are the five Cs of risk management.

Recommended For You:

Policy as Code (PaC): The Future of Automated Policy Management

VR Training Simulations: Enhancing Skills in Risk-Free Environments